san mateo county tax collector property tax

The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. Property Tax Bills and Refunds San.

San Mateo County Ca Goes Live With Taxsys Business Wire

You can submit forms using.

. The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are. Please fill out the applicable forms below.

Our mission is to ensure the safekeeping of public funds while maintaining liquidity. Online fat cavitation course. Click on the form you want to.

She acts as the banker for the. Tax Collector-Tax Bill Online Payment Receipt. Assessor - County Clerk - Recorder.

DocuSign to complete and submit with e-signature. San Mateo County collects on average 056 of a propertys. Casillas Jump to subpage.

If you own a home and occupy it as your principal place of residence on January 1 you may apply for an exemption of 7000 from the homes assessed value which reduces your property tax. Oassa cheer competition 2022 results. The San Joaquin County current year property tax roll is available online for inquiry or to make a payment by credit card debit card or E-Check.

Announcements footer toggle 2019 2022 Grant Street Group. The amount of taxes due for the current year can be found on the TreasurerTax Collectors web site or contact the Tax Collectors Office at 8662200308. The Property Tax Highlights publication includes information on the following.

The Treasurer-Tax Collectors Office proudly serves the residents and taxpayers of San Joaquin County. Nature of Question Tax Payments. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

General Tax Information Secured. San bernardino county recorder holidays 2022. List of cbt techniques pdf.

Countywide Tax Secured 100000000. Property Tax Postponement for Senior Citizens Blind or Disabled Persons On February 20. Beginning July 1 2022 if adopted by voters the special tax shall be collected by the County of San Mateo Treasurer- Tax Collector County Tax Collector.

Welcome to the San Benito County Tax Collectors Website Melinda L. Payment plans may not be started online. Account 074-083-260 3600 ALAMEDA.

Search and Pay Business License. However they are still required to. Some San Mateo County property owners whose properties were in the.

For comparison the median home value in San Mateo County is. With approximately 237000 assessments each year. The law provides property tax relief to property owners if the value of their property falls below its assessed value.

Largest county jail in florida. San Mateo County TreasurerTax Collector Sandie Arnott an elected official is charged with managing and protecting the Countys financial assets. 2009 the Governor signed Chapter 4 Statutes of 2009 which immediately suspends the Senior.

2019 2022 Grant Street Group. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number. Nature of Question Tax Rates.

As the rate for unpaid ad. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800. Small business owners may be exempt from personal property tax assessment in San Mateo County if their personal property is valued at 5000 or less.

Search and Pay Property Tax. A summary of the property tax process in San Mateo County. 3600 ALAMEDA MENLO PARK.

Financial information for the fiscal year.

Pay Property Taxes Online County Of Solano Papergov

County Of San Mateo Government Now That The Property Tax Bill Deadline Is Behind Us Did You Know That You Can Find All Of The County S Property Tax Data By

County Of San Mateo Government Quick Tip Tuesday It S That Time Of Year Again Secured Property Taxes Are Due By 5 P M On Dec 10 Payments May Be Made Online

San Mateo County Assessor County Clerk Recorder Elections Acre

Understanding California S Property Taxes

Alameda County Tax Collector Announces Property Tax Penalty Waiver Procedure News Pleasantonweekly Com

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

San Mateo County Postpones Property Tax Due Date Until May 4 Palo Alto Daily Post

Why Property Taxes Are Still Due In San Diego County On Friday Cbs8 Com

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

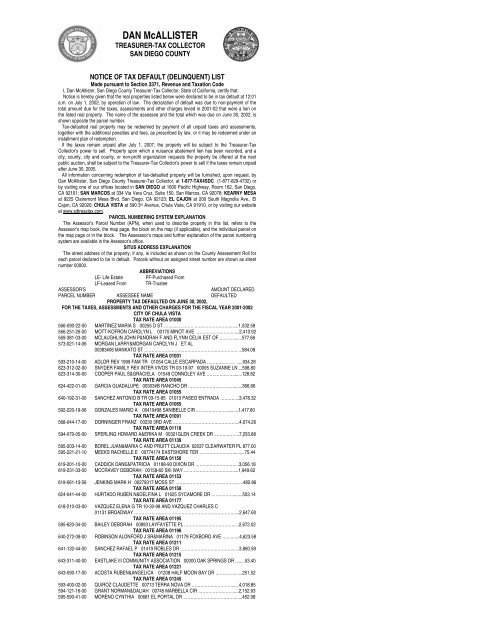

Dan Mcallister County Of San Diego Treasurer Tax Collector

Property Tax Deadlines Andy Real Estate

Cost Of Housing And Transportation Sustainable San Mateo County

Bay Area Real Estate Recovery Creates Property Tax Appeal Opportunities

Bay Area Property Tax Rolls Are Up 6 7 This Year It S Next Year Assessors Worry About

San Mateo County Ca Goes Live With Taxsys Business Wire

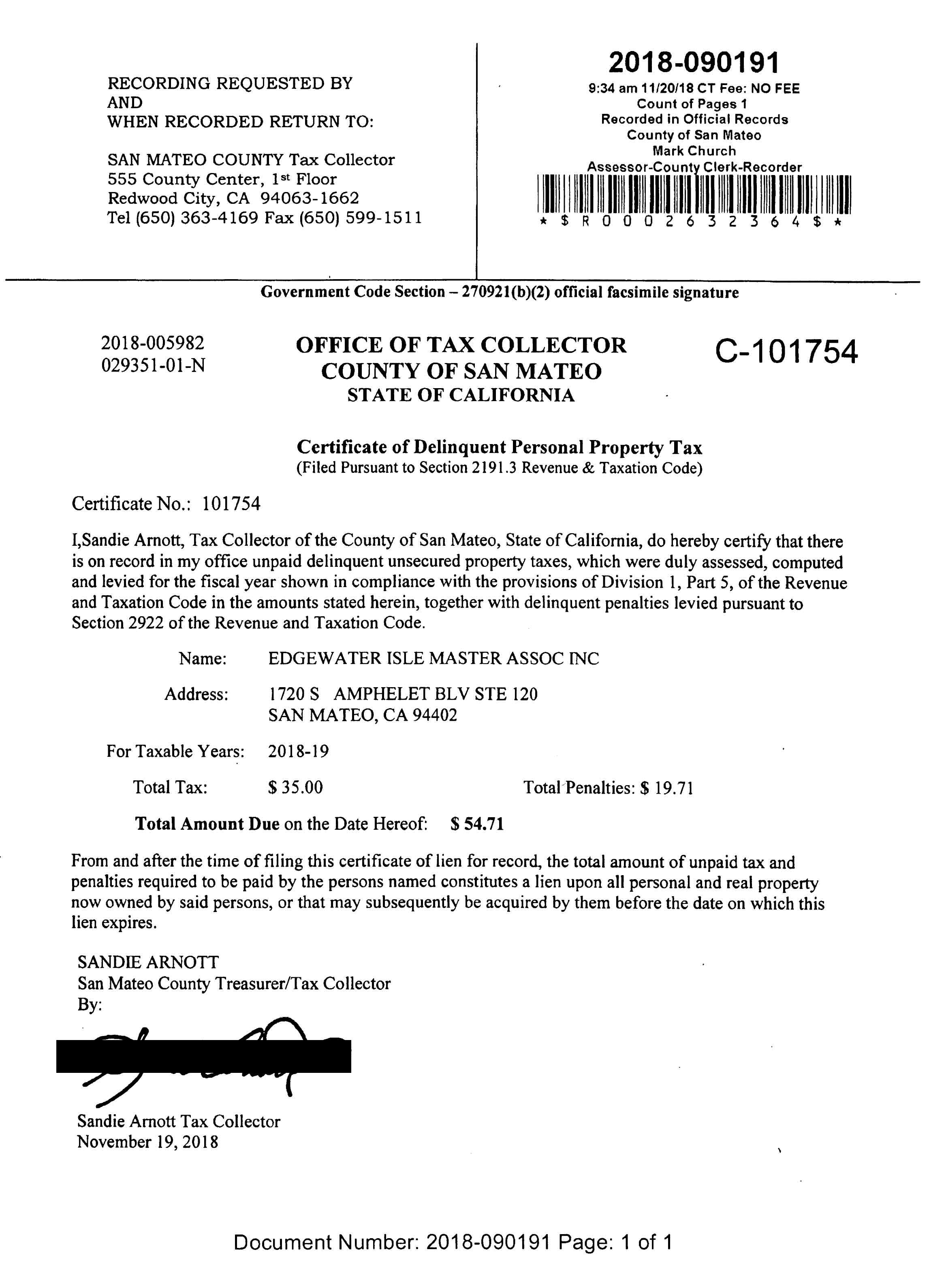

San Mateo County Issues Liens Against Master Association

Early Property Tax Payments Homeowners May Benefit Lamorinda Ca Patch

A Coronavirus Property Tax Delay Californians Shouldn T Count On It